Iraqi Microfinance Network

IMFI.org is the Iraqi Microfinance Knowledge Portal. This website presents the Iraqi microfinance industry, and its constituent 9 microfinance institutions (MFIs). It highlights the qualities, performance, impact as well as issues facing the industry as it grows, becomes more sustainable, and with some of its MFIs in the process of transforming from nongovernmental organizational (NGO) status to that of non-bank financial intermediaries (NBFIs). The main reasons for its establishment were the felt need for microfinance practitioners to have a common voice; to lobby government for favorable policies; to share information and experiences; and to link up and network with both local and international actors

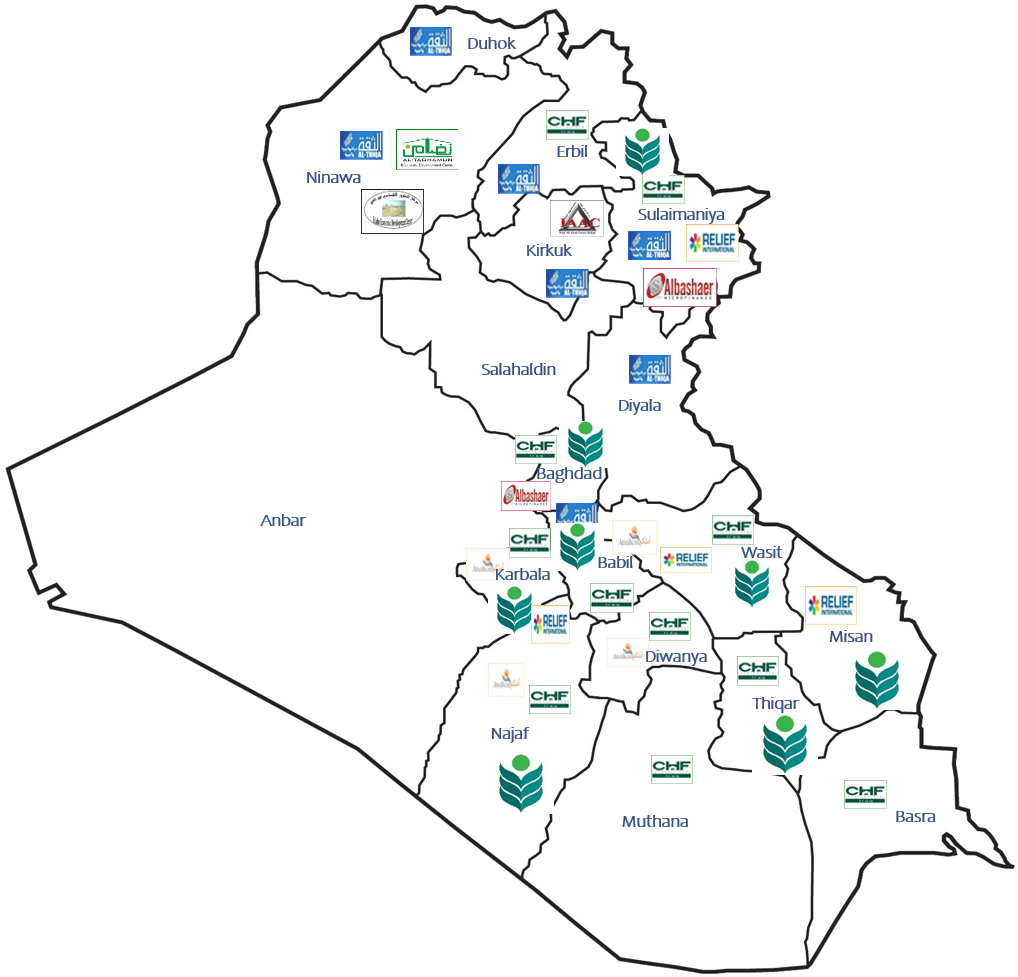

LOCATIONS

Across Iraq

+51

9

PARTNERS

EMPLOYEES

+781

189,417,316,440

IQD

ACTIVE LOANS

CORE VALUES

Creating a more comprehensive financial and non-financial services sector in Iraq that effectively meets the financial and non-financial needs of the poor, small and micro enterprise owners, and women to improve their level.

Increasing access to the microfinance sector in Iraq, innovation, following best practices and unifying it.

- Providing training and exchanging experiences between microfinance institutions and other parties.

- Providing technical support to entities working in the field of financing small and medium enterprises.

- Enhancing creativity in the field of financing small and medium enterprises through research and highlighting the main trends in technological developments and the diversity of new financial products and services.

- Gaining support for an enabling and supportive microfinance environment and integrating microfinance into the financial sector.

- Establishing strategic alliances with banks, non-banking financial institutions, donors, financiers and stakeholders in the government.

- Promoting governance and management principles and disseminating and requiring compliance with best practices in all industry facilities.

- To be at the forefront of helping the industry in managing risks and working with internal controls that will create sustainable growth.

Partners & Locations