Journey of Impact: Activities and Successes

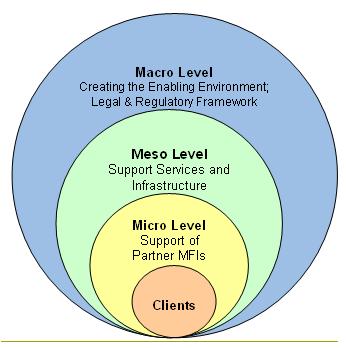

Building the Iraqi Microfinance Industry

The Iraqi microfinance industry (MFI) is increasing and improving the quality of the access to inclusive, quality financial services. Such services are crucial to making the Iraqi financial sector inclusive even to the poorest of people by offering and providing quality financial services on a sustainable basis. Training and technical assistance to MFIs will continue. The industry is progressing in dialogue with the Central Bank of Iraq (CBI) and other Iraqi authorities to support transforming MFIs. The industry will also continue dialogue with funders, current and potential, to adhere to and respect microfinance best practice standards.

Impactful Stories

The IMFI is proud to have positively impacted countless ideas and projects through various microfinance opportunities. We are delighted to share a selection of these inspiring stories, showcasing how the IMFI has empowered individuals and communities. Through dedication and support, we have helped turn dreams into reality, fostering growth and success along the way.

Ancient Craft, Modern Success

Safa al-Din Suhaib al-Mashhadani, 31 years old graduated from the Faculty of…

Microfinance Artistry: Keeping Art Alive

A young artist is keeping the art and culture of Iraq alive…

The Iraq Microfinance Industry: Revitalizing Local Communities

Iraq’s microfinance industry is rapidly expanding to become a powerful indigenous force…

A Honey of a Job

A young Iraqi beekeeper sets up his own honey production business with…

Iraqi Youth Initiative: Putting Youth to Work

The goal of the Iraqi Youth Initiative is to reduce youth unemployment…